Table of Contents

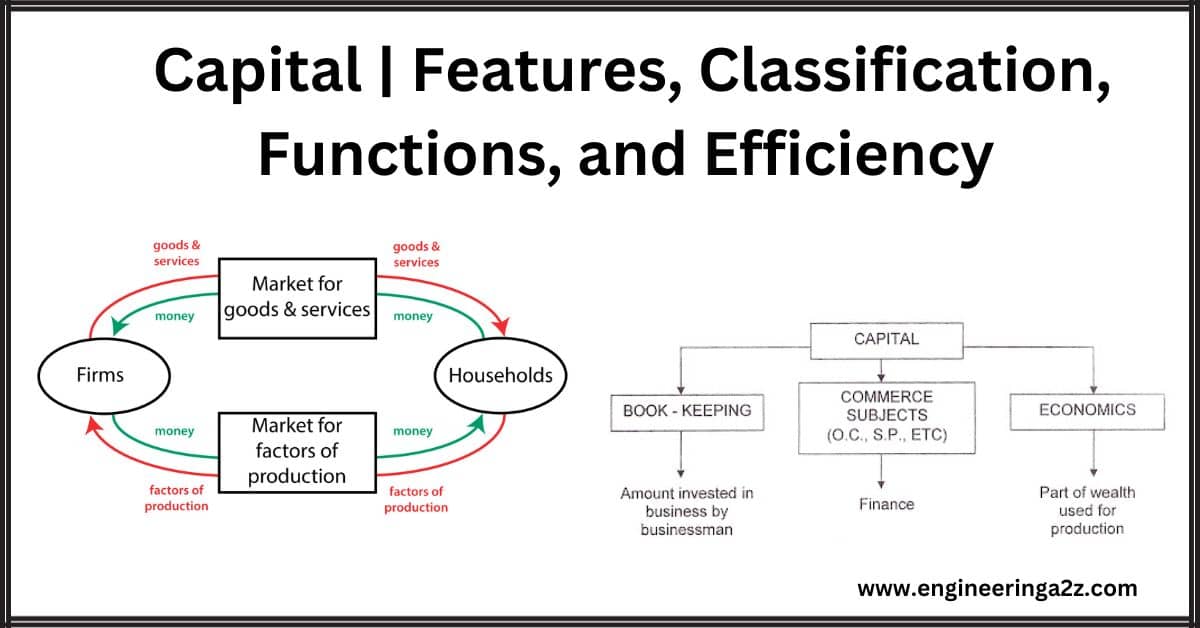

Capital

Capital is a crucial factor in production. In everyday language, we often use terms like wealth, capital, and money interchangeably. However, in economics, capital refers to the portion of wealth that is employed to create more wealth or income. It includes productive assets such as machines, buildings used for rent, savings in banks, and more.

Whether something is considered capital depends on its purpose. An item that is capital in one context may be seen as wealth in another. For example, an electric fan in a household is wealth, but the same fan in a cinema is considered capital. Coal in a factory is capital, while a comb in your pocket is wealth, but in a hair-cutting salon, it becomes capital.

Capital is the result of human effort and consists of two main components:

- Physical capital: This includes movable assets like seeds, fertilizers, and business-related assets such as a firm’s goodwill.

- Financial capital: This category encompasses items like bonds and shares.

In simple terms, capital is the part of wealth created through human effort with the assistance of nature. It is used to generate more wealth, such as seeds, manure, machines, and tractors. Therefore, capital essentially has two primary elements: it’s a portion of the wealth generated by people in collaboration with nature, and it’s utilized to produce additional wealth.

Features of Capital

The main features of capital as a factor of production are as follows:

(1) Man-made factor: Capital is produced by man by saving wealth. So it is also called stored labour. Like land, it is not a free gift of nature. That wealth that is put for some productive use fielding income is called capital. Thus man is the producer of capital.

(2) Secondary Factor of Production: Capital is not the most important thing for making things. People used to create things using only their hands, without any tools or equipment. So, you can produce things without having a lot of money or equipment.

(3) Capital is transferable: Capital can be transferred from one person to the other or from one place to the other. Mr. Mohan’s car. sell his textile mills to Mr. Sohan.

(4) Depreciation: When we use capital assets like machines, they wear out over time. Some machines wear out fast, while others wear out more slowly. It depends on how durable they are. So, eventually, we have to replace these machines or equipment.

(5) Capital is mobile: Out of all the things we use to produce stuff, capital is the most movable. You can easily shift it from one job or place to another.

(6) Passive Factor: Capital is a passive factor of production. It can produce nothing without the help of labour. In modern times with the increasing use of automatic machines, dependence on capital labour has decreased.

(7) Rapid change in Supply: Compared to other factors of production, the supply of capital can easily increase or decrease. The supply of land cannot be enhanced and that of labour cannot be increased.

(8) Capital is not a gift: The individual and the society both have to toil hard and make sacrifices to accumulate capital. It is not a gift like land. It is man-made and not a free gift in nature.

(9) Capital depends on the use of wealth: Capital is composed of wealth but all wealth is capital. Whether wealth will become capital or not depends upon its use. If wealth is used for the production of wealth or income it is called capital. A car used as a taxi is a capital because it serves source of income but a car used as a joy ride is wealth.

(10) Capital is the result of Savings: Capital is the result of saving money. When we don’t spend all of our earnings and set some aside, that leftover money is called savings. When we use these savings for productive purposes, it becomes capital.

Classification of Capital

Based on its use, ownership, etc; capital can be classified as under:

Capital is mainly of two types: (i) Real Capital and (ii) Financial Capital.

1. Real Capital

Real capital refers to those goods which are used for the production of other goods and services. For example, machines, equipment, tools, raw material, etc. fall into this category. Real capital helps induction and generation of income. Real capital can be of the following kinds.

(1) Fixed Capital: Capital can be used many times in producing goods. It is durable. It yields income again and again for some time. Machines are used again and again in workshops. A surgeon uses his tools again and again. A tailor has made use of his sewing machine for years. Accordingly, machines, tools, factory buildings, etc: are examples of fixed capital.

(2) Circulating Capital: It is that capital that is used up after one application. Fertilizers used in fields are an example of circulating capital. Cotton in textile mills is a circulating capital. Ink use printing books cannot be used again. Such a capital changes its form in one use. Accordingly, raw materials electricity, coal, etc. are the instances of circulating capital. It is of two types:

- Working Capital: This capital is used in production activity directly e.g. raw material, wages, etc.

- Loanable Capital: That capital which is given on a loan to earn interest.

(3) Floating Capital: Floating capital is that capital can be used for several purposes by several industries. Money can be used for any purpose. Electricity can be used in any industry. Leather can be used for making shoes, belts, handbags, suitcases, etc. Thus, money, electricity, and different materials are instances of floating capital.

(4) Suck Capital: Suck capital is that capital which is adopted to only one use. Printing Mac can be used only for printing purposes. Railway lines are used for plying railway coaches alone.

(5) Material Capital: Material capital, as defined by Thomas, encompasses tangible, transferable objects like machines, factory buildings, and raw materials. These assets can be physically seen and touched and are transferable to others. They constitute the tangible foundation of wealth and industry.

Personal capital, on the other hand, comprises intangible qualities and skills that enhance an individual’s efficiency and income-earning potential. These are inherent personal qualities, such as a singer’s melodious voice, which cannot be transferred to another person.

(6) Production Capital: According to Marshall, “Production capital consists of all goods aid labour in production.” Production capital refers to that capital that directly helps production. machines, tools, raw materials, etc.

2. Financial Capital

Financial capital is like paper ownership documents, such as shares, bonds, and debentures. Owning these doesn’t directly make things or produce goods; they represent your ownership of real assets. For example, if you have shares worth Rs. 2,000 in a company, they show that you have a claim on that company’s assets, but this doesn’t impact the whole society’s wealth.

Financial capital is essentially stored purchasing power. It means you can use it to buy things or services. Think of it as proof that you own part of something valuable. For instance, shares or debentures of a company represent real assets like factories and machines. Losing the paper certificates doesn’t affect the actual production of goods.

Money, like currency notes, also represents financial capital. It’s a promise from the government or a bank that you can exchange it for goods or services. But the value of these assets (like money) and liabilities (the promise to pay) is balanced. However, increasing the amount of money in circulation doesn’t increase the real wealth or goods produced in a country.

In a nutshell, financial capital consists of paper documents that pay you interest or dividends and help you earn income. Losing them or getting rid of them doesn’t harm the production of goods.

Functions and Importance of Capital

Pre-independence, regions like Punjab, Haryana, and Himachal Pradesh in India were impoverished. Post-independence, their efficient capital investments transformed them into prosperous areas. Capital is a key driver of economic growth worldwide. Poor nations lack capital and advanced techniques, while rich countries possess ample capital. Capital is vital for production and underpins modern production systems.

(1) Basis of Production: Capital is the basis of all types of production. It is capital that provides (i) raw materials (ii) machines and tools and (iii) wages to labourers in industries and agriculture etc. not possible to produce anything without capital.

(2) Basis of Efficient Labour: Capital makes workers better at their jobs in two main ways. First, when capital is used for things like education, health, and training, it helps improve the skills of the workers. Second, when workers have access to good modern tools and machines, it helps them produce more. For example, a farmer needs tools like a plow, oxen, seeds, and fertilizers to grow crops, and a fisherman needs a big net and a boat to catch fish. So, having the right tools and equipment is essential for efficient work. That’s why we say capital is the foundation of effective labour.

(3) Basis of the modern system of production: The way we make things today is a bit indirect. We have to first create the materials and tools needed to make a product before we can actually produce it. For example, in the past, people would use tree bark to cover themselves, but now we make textiles and sewing machines first to create clothing. Nowadays, just having land and labour isn’t enough to produce a lot; we need all the materials and machinery to do it efficiently.

(4) Basis of Transport: Economic activity does not come to an end with the production of goods. The goods produced must be transported to the market for disposal and raw materials must be forwarded to manufacturing industries. This is done through different means of transport, viz, railways, trucks, stand, etc. It is capital again that makes means of transport available.

(5) Basis of Technical Progress: Capital not only makes it possible to develop new technology and come up with new inventions but also helps bring these inventions to life. When we use capital for this, it leads to technical advancements that make work more efficient and products cheaper. This means more people can buy these goods, which makes the market bigger. So, capital is the main driver of technical progress.

(6) Basis of Trade: Expansion of internal and foreign trade also depends on capital. Large production is made possible by the use of capital. Large-scale production implies the low cost of the product and the low price of the finished product. Thus demand increases tremendously. Capital also makes po wide publicity of the goods produced. In advanced countries, manufacturing concerns spend millions of dollars on making and advertising Multinational companies like Bata, Lever Brothers, and Coca-Cola invest huge amounts of capital in foreign countries and thus expand their trade.

(7) Basis of Credit: Credit is the backbone of trade and industry. Expansion of credit facilitates Expansion of trade Credit itself depends upon the amount of capital. Traders who have large cap resources command a good deal of credit in the capital market. If the capital Invested in your factory building machines and other equipment amounts to Rupees 10 lakhs, you may procure credit worth Rupees se lakh on its basis from any financial institution. Capital thus serves as a basis of credit.

Efficiency of Capital

Increased production does not depend upon the quantity of production alone it requires efficient capital. Efficiency of capital refers to the quality of capital by which it produces goods of improved quality in large quantities. The following factors influence the efficiency of capital:

(1) Suitability: Efficiency of capital depends upon whether it is suitable for the use to which it is being put or not. If a textile mill is to produce a thousand meters of cloth per day, then it must Install large power looms. A small hand-loom will not be suitable for the purpose.

(2) Method of Use: Efficiency of capital is also determined by the method of its use. If the labourer was fully competent in operating a machine he could produce maximum output by its use. If he does not know how to handle it, he cannot produce much with its help.

(3) Ability of the Organiser: Efficiency of capital also depends upon the ability of the organism. An able organizer puts machines in charge of competent labourers. This will add to the efficiency of machines.

(4) Quality of Capital: Efficiency of capital is also determined by its quality. If capital, that is machines, etc is of high quality, productivity will be more. If, on the other hand, machines are obsolete and of poor quality then production will be very little.

(5) Quality of Raw Material: The use of high-quality raw materials adds to the efficiency of capital.

(6) New Inventions: New inventions help increase the productive capacity of capital. There are better sub-processes. If each process is not attended to with equal efficiency, total production will be less. zation of capital and cost of production goes down.

(7) Proper Coordination: Due to the division of labour, work can be divided into many processes and sub-processes. If each process is not attended to with equal efficiency, total production will be less. For example, the work of manufacturing cars is divided into different departments.

Factors Affecting Capital Formation

Capital formation is affected by these factors:

- Volume of Saving

- Mobilization of Saving

- Investment of Saving.

A comprehensive study of all three factors affecting capital formation will be of Immense use.

1. Volume of Savings

The larger the volume of savings in a country, the greater capital formation. The volume depends upon three things.

(A) Power to Save (B) Willingness to Save (C) Facilities to save.

A) Power to Save

Whether a person or a country can save money depends on the gap between their income (the money they make) and their expenses (the money they spend). If someone makes more money than they spend, they have a better chance of saving money.

For a whole country, the ability to save is influenced by two main things:

(i) National Income and (ii) Standard of living of people.

(B) Willingness to Save

Being willing to save money is just as important as having the ability to save when it comes to building up capital. Even if someone doesn’t have much money to spare, if they really want to save, they can manage to do it, even if it’s just a small amount. On the other hand, a wealthy person may have the means to save, but if they don’t have the determination to do it, they might not save anything at all.

Whether or not a person wants to save depends on several factors:

(C) Facilities to Save

The volume of savings also depends upon facilities to save. If people have the power and willingness to

ve but lack the facilities to save, then there can be no savings. The following facilities are conducive to saving:

(1) Peace and Security (ii) Taxation Policy (ii) Purchasing power of money (iv) Capable Entrepreneurs

2. Mobilisation of Savings

Unless savings are invested in some productive channel, capital cannot be accumulated. It is, therefore, necessary to mobilize small savings affected by numerous small savers. Financial institutions in the country do the job of mobilizing savings. If the number of banks, cooperative credit societies, post office saving banks, insurance companies, investment trusts, and other financial institutions is large in the country there will be a large scope for capital formation. The monetary policy and taxation policy of the government should also be favorable and generous.

3. Investment of Savings

More saving does not result in capital formation. It must be invested in such activities as are conducive to the production of wealth. For example, investment in a new business, purchase of shares of a new company, installation of new machines, and construction of factory premises Capital is formed (accumulated) when savings are converted into investment.

Factors Influencing the Investment

Entrepreneurs invest money in businesses to make a profit. But predicting how much profit they will actually make is often uncertain. So, the amount they invest can change.

In the future, entrepreneurs will put money into a new venture as long as they expect to make enough profit from it to cover the interest they have to pay on the money they invested.

(1) Comparison between MEC and Interest: The profit you expect to make from investing a little bit more money is called the “marginal efficiency of capital” (MEC). If you borrow money for this investment, you’ll have to pay interest. But if you already have your own money, you can invest it in things like government bonds and earn interest on it.

When entrepreneurs decide to invest more money in a business, they compare the expected profit (MEC) with the interest rate they have to pay or the interest they can earn. They will keep investing as long as the expected profit is equal to the interest rate.

In simple terms, it’s all about balancing the potential profit from investment with the cost of borrowing or the return on your savings, and this can be influenced by technological advancements and innovations over time.

.(2) Technological Advances and Innovations Inducement to invest has very much influenced advancement in the world and has induced large-scale investment in new machines and industries. For instance, during the last five decades, technological advancement in the world has induced large-scale investment in new machines and industries.

(3) Maintenance of machinery and operating Costs: While calculating expected profitability, the entrepreneur takes into consideration the supply price of the machines and the cost likely to be incurred to maintain their operational efficiency. If these costs are high, net profit will be less and this will disco inducement to invest, and if these costs are low net profit will be high and inducement to invest more.

(4) Government policies: The taxation policy of the government also influences inducement to invest. High rates of taxes escalate the costs of the producers and lower the rate of expected profit or MEC causing a fall in the level of investment. If, however, taxes are light, investment will be enough.

(5) The present stock of Capital Goods: The amount of investment also depends on the existing capital goods i.e., machines, equipment, etc. If in an industry the existing stock of capital goods is scope for new investment will be large.

(6) Expectations: Inducement to invest also depends on business expectations. If the business conditions are good the businessmen will turn optimistic about the future and be willing to explore more. If existing business conditions are not so cheerful the businessmen will have a pessimistic view of the future expectations and it will cause a fall in the level of investment.

(7) Rate of Population Growth: If the population of the country is rising by leaps and bounds demand for new houses, schools, public parks, hospitals, roads, all types of furniture, varied cons goods, etc. To meet this ever-increasing demand there will be a need for new investment.

(8) Territorial Expansion: If new colonies and townships are being built up to accommodate an increasing population then huge private and public investment will be called for.

(9) Aggregate Demand: If aggregate demand in the country is quite large then all manufacturing units in the country will produce goods up to their full production capacity. Their profits will look thus inducement to invest brighten up.

In short, capital formation has great significance to every country. It depends on saving investment.

Frequently Asked Questions (FAQs)

What is Capital?

Capital refers to assets and resources, both physical (like machines) and financial (like stocks), used in production to create goods and services for economic benefit.

What is the source of Capital?

Sources of capital in economics include personal savings, loans from banks, investments from individuals or institutions, government grants, and retained earnings from business profits. These funds are used for investment and economic growth.

What is the importance of Capital?

Capital is vital in economics for financing production, innovation, and economic growth. It enables businesses to expand, create jobs, and improve productivity, contributing to overall economic development and prosperity.

What are the 2 main sources of Capital?

The two main sources of capital are equity capital, which involves ownership stakes like stocks, and debt capital, which includes loans and bonds that must be repaid with interest.

Read Also:

- Economics For Engineers Book PDF

- Demand Forecasting | Features, Uses, Purpose, and Methods

- Total Quality Management | History, Importance, and Characteristics

- Power Quality | Sources Of Pollution, Need, and Effects

- Supply: Law of Supply

Leave a Reply