Table of Contents

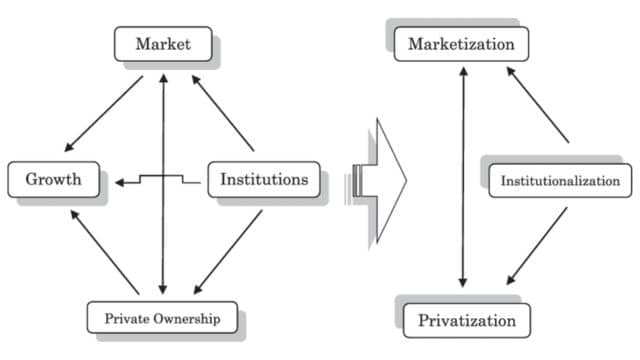

Privatization means different things, but it usually involves moving something from government control to private ownership. This can include selling government-owned businesses or services to private companies. For example, the government might sell a water supply company to a private company. It can also mean making a heavily regulated private industry less regulated.

Another type of privatization is when a government-owned company or corporation is sold to private investors, and its shares can be traded on the stock market. This is like when a previously government-owned company becomes privately owned and its shares are no longer traded publicly.

Lastly, privatization can also refer to a publicly traded company being bought by private investors, which means it becomes privately owned, and its shares are no longer traded on the stock exchange. This is often called “going private.”

Characteristics of Privatization

- Ownership Change: When something is privatized, it goes from being owned by the government to being owned by private individuals or companies.

- Less Government Involvement: With privatization, the government doesn’t control or interfere as much in how things are run.

- More Business Freedom: Privatization spreads economic activities among different companies instead of having the government control everything. It’s like letting more businesses have a say in how things are done.

Objectives of Privatization

- Better Efficiency: When the government runs things, it often focuses on politics, not making money. This can slow down growth. Privatization means less government control, so companies can work better and make more money.

- More Competition: Government-run companies often have no competition, which can make them lazy. Privatization brings in private companies that compete with each other. This competition makes industries and the economy grow faster and stops one company from having too much power.

- Dynamic Markets: Without government rules, markets can change and grow more naturally. People like this because it means they have more choices. When markets are dynamic, companies make more money.

- Government Cash: Sometimes, the government sells companies to get a big pile of money. They might do this when they need money urgently, like when they’re in financial trouble.

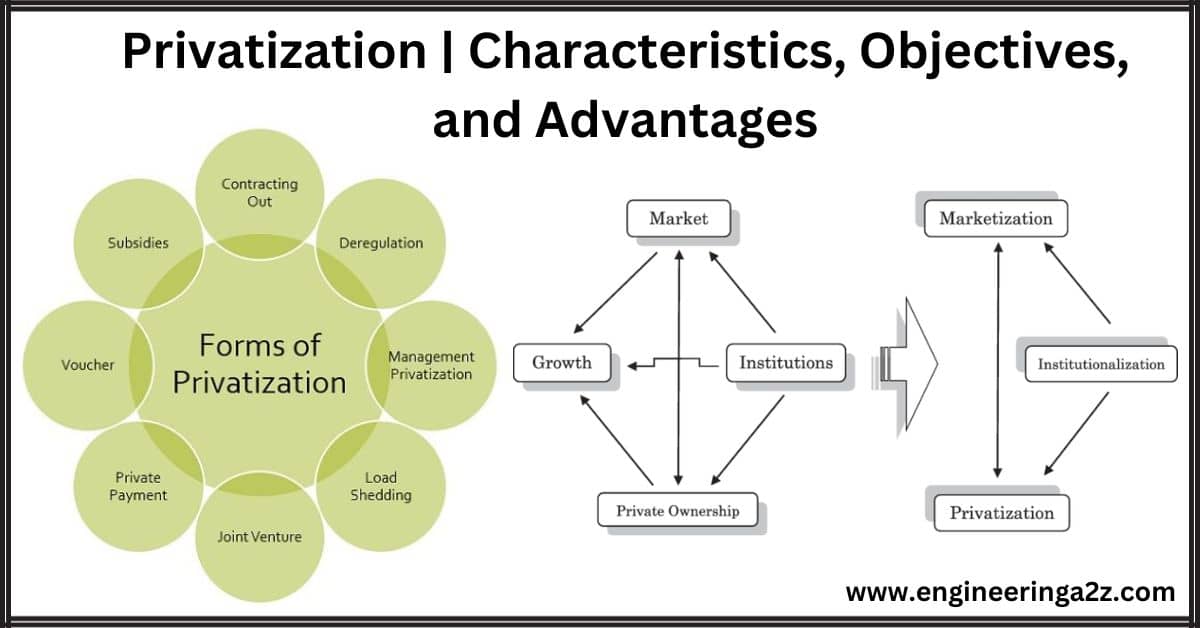

Methods of Privatization

Privatizing a company can happen in five main ways:

- Public Auction: Think of it like a big sale. The government tries to get the most money by selling shares or assets of a company to the highest bidder.

- Sale of Shares: It’s like selling pieces of the company on the stock market. The government gives up control of the company by selling shares to the public.

- Direct Negotiations: Here, the government talks directly with specific private companies to sell state-owned property. They agree on the terms that benefit both sides.

- Public Tender: This is like inviting offers from interested buyers through a contract. The highest bidder gets the deal, but it’s similar to direct negotiations except that anyone can participate.

- Lease with a Right to Purchase: A private company gets to use a state-owned company, but they might buy it later by meeting certain conditions and paying the right amount. It’s like renting with an option to buy.

Advantages of Privatization

- Better Performance: Private companies focus on making money, not politics. This means they work more efficiently, get rid of unnecessary rules, and reward employees who do well. This makes the whole company work better.

- Improved Customer Service: Private companies try hard to make customers happy because that helps them make money. Government-run companies don’t worry as much about this because they don’t have competition. Plus, privatization gets rid of annoying red tape.

- Good Management: Private companies are managed well because the managers know they have to answer to the owners. In government companies, managers don’t always feel this pressure, so things can be run poorly and harm the economy.

Disadvantage of Privatization

- Monopoly Manipulation: Sometimes, private companies can use their monopoly power to make more money and ignore the needs of the people. When the government privatizes industries like water and electricity, it can create single monopolies that are hard to control.

- Public Services: When important services like healthcare, education, and public transport are run by profit-focused private companies, they might not always do what’s best for the public. In India, for example, some private healthcare providers are not even qualified doctors.

- Accountability: The public has no say in how private companies are run. This can lead to less accountability because the owners of the company can do whatever they want.

- Uncertain Success: Privatization doesn’t guarantee that a company will succeed. Many private companies face big losses, and it’s not always clear if they’ll do well or not.

Examples of Privatization in India

Here are some examples of privatization in India:

- Bharat Aluminum Company in 2005: In 2005, the government sold a company called Bharat Aluminum to a private company. It means that a company that was owned by the government became owned by a private company.

- Delhi and Mumbai Airports in 2006: In 2006, the government allowed private companies to take control of the airports in Delhi and Mumbai. So, instead of the government running these airports, private companies started managing them.

Frequently Asked Questions (FAQs)

-

What is privatization?

Privatization is when the government sells or transfers ownership and control of public assets, like companies or services, to private individuals or businesses.

-

What are the characteristics of privatization?

Privatization involves transferring ownership from the public sector to the private sector, reducing government interference, promoting economic competition, and aiming for improved efficiency and financial gain.

-

What is the main aim of Privatisation?

The primary aim of privatization is to transfer ownership and control of government-owned assets to private individuals or companies, promoting efficiency, reducing government involvement, and potentially generating revenue for the government.

Read Also:

- Economics For Engineers Book PDF

- Power Quality | Sources Of Pollution, Need, and Effects

- Total Quality Management | History, Importance, and Characteristics

- Markets: Perfect competition, Monopoly, Monopolistic & Oligopoly

Leave a Reply